Our Investments

-

NeuVentus

Unrealized

NeuVentus

Unrealized

Lotus launched NeuVentus in February 2023. NeuVentus is a developer-owner-operator of pipeline transportation and salt cavern storage projects that serve North America’s energy transition and expansion. NeuVentus’ initial projects will be located in the Texas Gulf Coast region, which has abundant renewable energy production, natural gas, carbon sequestration geology and hydrogen demand to support the growth of a clean hydrogen infrastructure platform. In addition to clean hydrogen and its derivatives like ammonia and methanol, NeuVentus is expected to have the ability to provide transportation and storage services to adjacent industries (i.e. industrial gases). More information is available at: http://www.neuventus.com.

-

Ten West Link

Unrealized

Ten West Link

Unrealized

Ten West Link is an energy infrastructure project that connects electrical substations in Tonopah, Arizona and Blythe, California. The new 500kV power line improves transmission system efficiency and reliability while facilitating the development of new renewable energy and energy storage resources in Arizona and California. This helps both states achieve their renewable energy standards and carbon reduction goals.

Ten West Link also brings significant economic, reliability and public policy benefits to the electric power grid serving the Desert Southwest – one of America’s fastest-growing regions. The project spans 125 miles and uses the United States Department of Energy’s “Energy Corridor” and United States Bureau of Land Management’s designated utility corridors. Additionally, the final project route avoided the Kofa National Wildlife Refuge and all major population centers.

The project achieved commercial operation in June 2024. More information is available at: https://tenwestlink.com/.

-

Allium Renewable Energy

Unrealized

Allium Renewable Energy

Unrealized

In June 2024, Lotus acquired PNE USA, an established developer of utility scale wind, solar and battery energy storage in North America, from Germany-based PNE AG, and rebranded the company as Allium Renewable Energy (Allium). Allium is currently developing projects across the United States with a team of industry veterans. More information is available at: https://alliumenergy.com/.

-

Radial Power

Unrealized

Radial Power

Unrealized

Lotus formed Radial Power in May 2022 as a Commercial & Industrial (C&I) platform company and entered into a joint venture with energyRe in September 2022. Radial Power focuses on acquiring, installing and operating solar, battery storage and EV chargers on properties to serve C&I customers, community solar programs and utility programs.

The Radial Power leadership team has 90+ years of experience across all types of development, operations, M&A and financing, ideal for leading execution of projects in the portfolio’s pipeline. Radial Power’s first two foundational customers, Starwood Capital and the Related Companies have a footprint of 2,000+ assets nationwide. More information is available at: https://radialpower.com.

-

BerQ RNG

Unrealized

BerQ RNG

Unrealized

In August 2021, Lotus acquired a controlling stake in BerQ RNG (BerQ) along with its assets, operations, and intellectual property. BerQ is an established renewable natural gas (RNG) operator and developer with experience across all types of biogas feedstock, including landfill gas, manure and food waste, and currently owns a diverse portfolio of operating and development-stage RNG projects across the United States and Canada. More information is available at: http://www.berqrng.com.

-

Crane Solar

Unrealized

Crane Solar

Unrealized

Crane, located in Crane County, Texas, is a 150 MW AC solar project that sells energy and renewable energy credits to a subsidiary of Vistra Corporation. Lotus acquired the project from Con Edison Development in 2021. Crane was part of a portfolio that also included Coram Wind, which was sold in December 2021.

-

Shannon Wind

Unrealized

Shannon Wind

Unrealized

Shannon Wind is a 204 MW wind project located in Clay County. Construction financing for the project closed in June 2015 and it was completed in December 2015 on time and under budget.

The project benefits from 13-year offtake agreements and tax equity financing, which was used to repay construction debt at commercial operation. It also entered into a 13-year Renewable Energy Credit purchase agreement with Meta, formerly known as Facebook, Inc.

-

Stephens Ranch

Unrealized

Stephens Ranch

Unrealized

Stephens Ranch is a 376 MW, two-phase wind project located 45 miles south of Lubbock, Texas.

Lotus began construction on the projects in December 2013 through separate project financings for each phase. The 211 MW Phase I project was completed in November 2014 and the 165 MW Phase II project was completed in May 2015.

Both phases benefit from long-term offtake agreements and tax equity financing, which was used to repay construction debt at commercial operation. Construction of each phase was completed on time and under budget.

-

Northwest Ohio

Realized

Northwest Ohio

Realized

Northwest Ohio Wind is a 105 MW wind farm located in Paulding County, Ohio. The project closed financing in October 2017 and achieved commercial operation in August 2018. Construction was completed on time and under budget.

The project is contracted to General Motors for 100% of the project output under a long-term power purchase agreement.

Lotus sold its interests in Northwest Ohio Wind to an affiliate of CMS Energy, simultaneous with project completion.

-

Coram Wind

Realized

Coram Wind

Realized

Coram, located in Kern County, California, is a 102 MW wind project that sells capacity, energy and renewable energy credits to Pacific Gas and Electric under a power purchase agreement through 2032. Coram was part of a portfolio that also included Crane Solar and was sold in December 2021.

-

Horse Creek and Electra

Realized

Horse Creek and Electra

Realized

Horse Creek and Electra Wind are two 230MW wind farms located in Haskell and Wilbarger Counties, Texas. Each project consists of 100 GE 2.3-116 wind turbines. The projects benefit from 13-year offtake agreements with Bank of America Merrill Lynch and long-term fixed-price service agreements from GE.

Horse Creek and Electra closed construction debt and tax equity financing commitments in late 2015 and early 2016, respectively, and achieved commercial operation in late 2016. Lotus sold its interests in the projects to MEAG, the investment arm of MunichRE, and Skyline Renewables in separate transactions in 2017 and 2018, respectively.

-

Sault Ste. Marie (SSM) I, II, and III Realized

Lotus developed a 69 MW DC solar photovoltaic project in Sault Ste. Marie, Ontario, Canada. The project was completed in three phases between 2010 and 2011, all three of which were delivered on time and under budget. Power from the facilities is sold through 20-year power purchase agreements under the Ontario Power Authority’s Renewable Energy Standard Offer Program (RESOP). The financing of the first phase, which closed in December 2009, was one of the year’s largest solar project financings in North America. The financing of the second and third phases closed in September 2010 and June 2011, respectively.

At the time of its completion, the project was among the largest photovoltaic facilities in North America. In February 2013, the project was sold to an investment vehicle formed by KKR’s Global Infrastructure Fund.

-

Gainesville Renewable Energy Center (GREC)

Realized

Gainesville Renewable Energy Center (GREC)

Realized

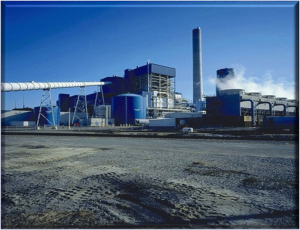

One of the largest biomass power plants in the United States, Gainesville Renewable Energy Center (GREC) is a 100 MW wood-fired power plant located in Gainesville, Florida. The project sold energy, capacity and environmental attributes to the City of Gainesville, Florida d/b/a Gainesville Regional Utilities (GRU) under a 30-year power purchase agreement.

The project was completed in late 2013, on time and under budget. GREC was named “2011 Biomass Deal of the Year” by Project Finance Magazine. Lotus and its partners sold GREC to GUR in 2017.

-

Berlin Station Realized

Berlin Station is a 75 MW wood-fired power plant in Berlin, New Hampshire, that was completed in 2013 and sold its energy, capacity and renewable energy credits to the Public Service Company of New Hampshire under a 20-year power purchase agreement.

In September 2015, Lotus sold its interest in Berlin to affiliates of one of the other owners of the project.

-

Nautilus Solar Energy

Realized

Nautilus Solar Energy

Realized

In December 2008, Lotus acquired Nautilus Solar Energy, a leading, fully integrated, solar independent power producer that develops, constructs, finances, owns and manages distributed solar generation systems across North America. Lotus had an extensive track record of working with Nautilus principals prior to acquiring the company. Under Lotus’ ownership, Nautilus constructed or managed over $400 million in solar systems throughout the United States and Canada, representing over 100 megawatts in nearly 80 different projects.

In 2014, Nautilus sold its operating assets to TerraForm Power, Inc. (pre-IPO). In September 2015, Lotus sold its interest in Nautilus in a buy-out led by Nautilus’s management who partnered with Virgo Investment Group.

-

Startrans (aka, “Meads Transmission”) Realized

Lotus owned a minority interest in two transmission lines that it acquired from the City of Vernon in California. The Mead-Adelanto project is a 1,296MW, 500kV AC transmission line that extends 202 miles from Southern Nevada to Southern California. The Mead-Phoenix project is a 1,900MW, 500kV AC transmission line that extends 256 miles from Southern Nevada to Central Arizona. Lotus sold its interest in 2023.

-

Hudson Transmission Project

Realized

Hudson Transmission Project

Realized

Hudson is a 660 MW, 345kV transmission line connecting Ridgefield, New Jersey with Midtown Manhattan. This critical infrastructure project includes approximately eight miles of buried transmission cable, four miles of which is beneath the Hudson River. Operating under a 20-year capacity purchase agreement, Hudson helps the New York Power Authority meet reliability standards for New York City. It also establishes a link to the larger and more diverse Pennsylvania-New Jersey-Maryland Interconnection (PJM) electricity market. The project began construction in 2010 and achieved commercial operation in the summer of 2013, on time and under budget. Lotus sold its interest in Hudson to Argo Infrastructure in March 2019.

-

Neptune Regional Transmission System

Realized

Neptune Regional Transmission System

Realized

Neptune is a subsea, 65-mile, 660MW high voltage DC transmission line that interconnects the Long Island Power Authority with the PJM regional transmission organization in Sayreville, New Jersey. The project began commercial operations in June 2007 on-schedule and under-budget. Neptune has historically met roughly 20% of Long Island’s annual power needs and generates stable, contracted cash flows through a 20-year firm transmission capacity purchase agreement with the Long Island Power Authority. Neptune won the North American Infrastructure Deal of the Year Award from Project Finance Magazine in 2005.

Lotus sold its interests in Neptune to Northwestern Mutual in April 2014.

-

Edgewater Generation Portfolio

Unrealized

Edgewater Generation Portfolio

Unrealized

Edgewater Generation is a portfolio of four natural gas-fired facilities. Fairless Energy Center (1,320 MW), Manchester Street Station (510 MW), and Garrison Energy Center (309 MW) are combined-cycle facilities located in Fairless Hills, Pennsylvania, Providence, Rhode Island, and Dover, Delaware, respectively. West Lorain Power (545 MW) is a simple-cycle facility located in Lorain, Ohio. Fairless and Garrison sell capacity and energy into the constrained PJM EMAAC region while West Lorain sells into the nearby constrained PJM ATSI region. Manchester sells capacity and energy in the ISO-NE region.

Garrison, Manchester Street and West Lorain also benefit from dual fuel capabilities. Lotus acquired Fairless and Manchester from Dominion in December 2018, West Lorain from First Energy in March 2019 and Garrison from Calpine in July 2019.

The portfolio also included the RockGen Energy facility, which was sold in December 2021.

-

Excalibur Power Portfolio

Unrealized

Excalibur Power Portfolio

Unrealized

The Excalibur Power Portfolio consists of interests in three facilities, Plum Point, a 680 MW facility located in Arkansas in the MISO regional market and the Chambers and Logan sites. Chambers and Logan were 262 MW, and 225 MW facilities located in New Jersey in the PJM regional market until they were retired in 2022.

Plum Point derives a significant majority of its revenue from availability-based power purchase agreements with investment-grade off-takers. Lotus closed the acquisition in late 2017 and closed the acquisition in early 2018. The portfolio also included the Morgantown facility, which was sold in June 2020.

Lotus retired and demolished/partially demolished Logan and Chambers – the last two coal-fired generation facilities in New Jersey – several years before their scheduled retirement and is evaluating alternative development opportunities for the sites, including battery energy storage.

A short video of the Logan Facility Implosion can be found here: Logan Implosion.

-

Greenleaf I & II

Unrealized

Greenleaf I & II

Unrealized

Greenleaf I & II were two 49.5 MW gas-fired generation facilities located in Yuba City, California. Both facilities were fully contracted to PG&E and Greenleaf II also sells process steam to an adjacent food processing facility.

Greenleaf I was retired as planned following the expiration of its PG&E contract. Lotus acquired the projects from MUFG in June 2016.

-

The Northeast Portfolio

Unrealized

The Northeast Portfolio

Unrealized

The Northeast Natural Gas Portfolio consists of two combined-cycle facilities in New York (Beaver Falls – 108 MW, and Syracuse – 103 MW), and one simple-cycle facility in Pennsylvania (Hazleton – 158 MW). The facilities sell power and capacity in the New York and PJM regional markets, respectively. Beaver Falls and Hazleton also benefit from dual-fuel capabilities.

Lotus closed the acquisition of the Northeast Natural Gas Portfolio in early 2015.

-

Quail Run Energy Center

Realized

Quail Run Energy Center

Realized

Quail Run Energy Center, located near Odessa in West Texas, began commercial operations in 2007 and has a nominal capacity of 550 MW. The facility provides electric power to the Electric Reliability Council of Texas (ERCOT) system, a power market serving over a million Texas customers and representing approximately 90 percent of the state’s electric load.

Lotus closed on the acquisition of Quail Run in January 2015. Quail Run was sold to Calpine in September 2024.

-

Dighton Power and Milford Power

Realized

Dighton Power and Milford Power

Realized

Dighton Power and Milford Power are located in Dighton, Massachusetts and Milford, Massachusetts respectively and sell capacity and energy into the ISO-NE market. Both assets were part of the Compass Portfolio. Dighton Power is a 177 MW 1×1 combined-cycle, natural gas-fired facility. Milford Power is a 202 MW 1×1 combined-cycle, natural gas-fired facility.

Lotus acquired the projects from Dynegy in 2017. Lotus sold its interests through two separate transactions. A 50% sale to JERA in 2018, and a sale of the remaining 50% to EGCO in 2024.

-

RockGen Energy

Realized

RockGen Energy

Realized

RockGen Energy (503 MW) is a simple-cycle facility located in Cambridge, Wisconsin. It was acquired by Lotus from Calpine in 2019 and is part of the Edgewater portfolio. RockGen sells capacity into the MISO region and also benefits from dual-fuel capabilities.

The RockGen facility was sold to Dairyland Power Cooperative in December 2021.

-

Morgantown Energy Associates

Realized

Morgantown Energy Associates

Realized

Morgantown Energy Associates (MEA) owned a 62 MW facility located in PJM and was acquired by Lotus as part of the Excalibur portfolio in 2018. The project had a long-term Electric Energy Purchase Agreement (EEPA) with Monongahela Power Company (Mon Power), a subsidiary of FirstEnergy Corp, through 2027. The EEPA was terminated by MEA and Mon Power in 2019 and facilitated the early retirement of inefficient coal-fired electrical production at the facility, which has been in service since 1991.

Lotus led the transition to natural-gas-fueled steam-only production to support the project’s obligations with West Virginia University (WVU), providing reliable steam supply through existing and new infrastructure investments.

The EEPA termination ended electric production and led to the eventual shutdown of the waste coal boilers, which provided numerous benefits to the Morgantown, WV community. The project was sold to Vicinity, a portfolio company of Antin Infrastructure Partners, in July 2020.

-

Marcus Hook Energy Center

Realized

Marcus Hook Energy Center

Realized

Marcus Hook Energy Center, located southwest of Philadelphia, Pennsylvania is comprised of two assets, an efficient 848 MW 3×1 combined-cycle natural-gas-fired facility and MH50, a 50 MW peaking facility. The assets were part of the Compass Portfolio and are contained within the Sunoco Logistics refinery, to which the plants have historically sold process steam. The combined-cycle facility, constructed in 2004, has a long-term capacity contract with the Long Island Power Authority through 2030 and sells energy into the constrained PECO region of PJM. The MH50 peaker was retired as planned in May 2019.

Lotus acquired the projects from NextEra Energy in 2016.. The Compass portfolio which also included Dighton Power and Milford Power was sold to an affiliate of EGCO Group in January 2024.

-

Calpeak Power

Realized

Calpeak Power

Realized

CalPeak is a portfolio of five simple-cycle, natural gas-fired peaking projects in California with a total capacity of 260MW. The plants were fully contracted with the California Department of Water Resources through 2011. Lotus acquired the plants from United Technologies Corporation in May 2006. The financing for the acquisition was named the “North America Portfolio Financing Deal of the Year” in 2006 by Project Finance Magazine.

Lotus sold its interests in the company to affiliates of Carlyle Infrastructure Partners in September 2013.

-

Midway Project Realized

Midway was a 120 MW simple-cycle peaking plant, located 60 miles west of Fresno, California, that was developed exclusively by Lotus. The project closed financing in March 2008 and was completed in May 2009, on time and under budget. Midway generates contracted cash flows under a 15-year power purchase agreement with Pacific Gas & Electric (PG&E).

Lotus sold its interests in the company to affiliates of Carlyle Infrastructure Partners in September 2013.

-

Richland Stryker Realized

Richland and Stryker are, respectively, 444 MW and 20 MW simple-cycle power plants located in Northwest Ohio. The projects are situated within the constrained ATSI zone and participated in the PJM forward capacity market. Lotus was the largest investor in a consortium that acquired the projects from FirstEnergy Generation Corporation in 2011.

Lotus and its partners closed the sale of Richland and Stryker to Energy Capital Partners in December 2013.

-

Thermo Fort Lupton Realized

Thermo was a 272 MW combined-cycle power plant and associated greenhouse steam-host located approximately 25 miles northeast of Denver, Colorado. The project was fully contracted through 2019 via tolling agreements with the Public Service Company of Colorado and the Tri-State Generation and Transmission Association. Thermo is a key resource for Colorado because it serves as “spinning reserve” capacity, which can be brought online quickly to meet fluctuations in net power supply and demand caused by a heavy reliance on intermittent renewable generation.

In December 2011, Lotus sold its interests to the Tri-State Generation and Transmission Association.

Includes some investments initiated under Starwood Capital Group Management, LLC, the predecessor investment manager for some of the Lotus funds.

-

Gulf Coast Ammonia

Unrealized

Gulf Coast Ammonia

Unrealized

Gulf Coast Ammonia (GCA) is a 1.3-million-ton-per year ammonia facility under construction, located in Texas City, Texas and is expected to be the world’s largest single-train ammonia synthesis loop once completed. The long-term cash flows of the facility are supported by 15-year offtake agreements. More information is available at: http://gulfcoastammonia.com.

-

Lavaca Midstream

Unrealized

Lavaca Midstream

Unrealized

Lavaca Midstream is an approximately 300-mile, recently constructed natural gas gathering and compression system located in Lavaca County, South Texas. The system provides gas gathering and compressed gas re-injection services to local oil and gas producers in the Eagle Ford Shale. Lotus acquired Lavaca Midstream from Third Coast Midstream, LLC, in December 2019.

Includes some investments initiated under Starwood Capital Group Management, LLC, the predecessor investment manager for some of the Lotus funds.

Berlin, NH

Offices in Canada and in Canonsburg, PA

Kern County, CA

Crane County, TX

Dighton, MA

Milford, MA

Osceola, AR

Carney’s Point, NJ

Swedesboro, NJ

Gainesville, FL

Yuba City, CA

Texas City, TX

Midtown Manhattan, NY

Lavaca County, South Texas

Marcus Hook, PA

Offices in NY & in TX

Cambridge, WI

Clay County, TX

Ontario, CA

south of Lubbock, TX

Substations in Tonopah, AZ & Blythe, CA

Denver, CO

Includes some investments initiated under Starwood Capital Group Management, LLC, the predecessor investment manager for some of the Lotus funds.